Cha-Ching! Positive Habits for Money Success

In the complex dance of life, we can never underestimate the significance of money.

It’s not just a medium of exchange; it’s a force that can empower or constrain our dreams.

The path to wealth manifestation and financial abundance is often paved with positive money habits that guide us toward success.

We’ll explore the world of these habits, examining their significance and how they can support your journey toward achieving your goals, whether to manifest career success or attain financial security.

Understanding the Power of Habits

Habits are the routines that define our daily lives.

They’re the behaviors we perform almost automatically, often without conscious thought.

When it comes to finances, understanding the role of habits is paramount.

We can take conscious control by recognizing that deeply ingrained habits often influence our financial decisions.

Let’s say you have a habit of making an impulsive purchase whenever you feel stressed.

Recognizing this habit allows you to develop alternative coping strategies, such as going for a walk or practicing deep breathing, instead of spending money unnecessarily.

The Psychology of Wealth Manifestation

At the heart of wealth manifestation is the psychology of money.

Your relationship with money is intricately linked to your beliefs, attitudes, and habits.

To manifest wealth, one must delve into the psychology of money.

This means exploring our beliefs and attitudes toward money and transforming them positively.

Consider someone who grew up in a household where money was always tight, leading to a belief that there’s never enough.

To change this mindset, they might work on acknowledging their financial successes, no matter how small, and gradually shift their belief from scarcity to financial abundance.

Harnessing the Magic of Positive Affirmations

Positive affirmations are like seeds planted in the fertile soil of the subconscious mind.

When we craft affirmations for money, we are consciously programming our minds to focus on the positive aspects of our financial journey.

These affirmations serve as daily reminders of our financial objectives and help instill confidence in our ability to achieve them.

An individual looking to boost their income might repeat the affirmation, “I am capable of increasing my earnings through my skills and hard work.”

By doing so consistently, they reinforce their belief in enhancing their financial situation

Positive affirmations maintain our concentration and motivation and, most importantly, kindle a sense of optimism as we pursue our ambitions. Strive for positive language infused with optimism about the future. Ensure that each affirmation bears a unique, personal relevance to you.

Embracing Financial Mindfulness

Financial mindfulness involves being fully present in our financial decisions, acknowledging our choices, and assessing their impact.

By practicing mindfulness, we can avoid impulsive spending and make conscious choices that align with our financial goals.

Suppose you’re about to make a significant purchase.

Financial mindfulness entails asking yourself whether this expense aligns with your financial goals.

Are you purchasing out of necessity or impulse?

This simple pause can prevent hasty decisions.

The Art of Setting Clear Financial Goals

Setting clear and achievable financial goals is the first step toward money manifestation.

Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

If your goal is to manifest career success by increasing your income, you could set a SMART goal such as, “I will earn a 10% higher income within the next 12 months by negotiating a raise at work and taking on freelance projects.”

Financial goal setting is your North Star, guiding you toward the shores of financial security and prosperity. The clearer your vision, the more precise your goals become. To manifest wealth, you must articulate what wealth means to you.

Budgeting: The Bedrock of Financial Success

Budgeting isn’t about restriction; it’s about empowerment. It provides:

- A clear picture of your financial landscape.

- Highlighting your income, expenses, and savings objectives.

- Allowing you to make informed decisions.

Suggestion: Create a monthly budget that outlines your income sources and expenses, including fixed bills and discretionary spending like dining out.

Review this budget regularly to ensure you stay on track with your financial goals.

Automate Savings and Investments

The age-old adage, “out of sight, out of mind,” holds in finance.

Automating your savings and investments ensures that a portion of your income is consistently allocated toward your financial goals.

It removes the temptation to spend impulsively and enforces a disciplined approach to saving.

Suggestion: Set up an automatic transfer from your checking account to your savings or investment account on the day you receive your paycheck.

This way, you’re saving before you spend the money elsewhere.

Practicing Frugality Without Sacrifice

Frugality is often misunderstood as deprivation.

In reality, it’s about conscious spending.

It encourages us to evaluate our expenses critically and find value in our purchases.

Instead of sacrificing your daily coffee, consider making it home or finding more cost-effective alternatives.

This way, you can still enjoy your coffee without overspending.

Effective Debt Management

Managing debt is a crucial aspect of financial well-being.

Prioritize paying off high-interest debts and avoid accumulating additional debt, freeing up financial resources that can be directed toward your goals.

You might employ the debt snowball method if you have multiple debts.

This involves paying off the smallest debt first while making minimum payments on more enormous debts.

Once you have paid the smallest debt, you redirect the money to the next smallest debt, creating a snowball effect.

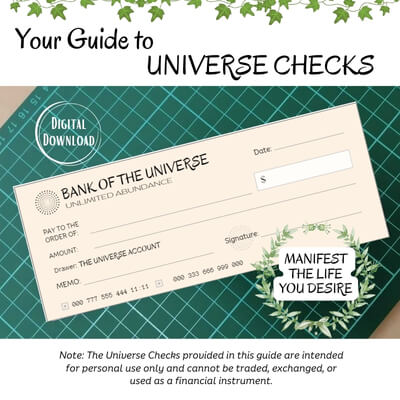

Universe Checks, also known as Abundance Checks, are a powerful tool used in manifestation practices.

Universe Checks physically represent our intentions, acting as a symbolic contract with the universe.

Regularly Review Your Finances

Financial review is like a compass that keeps us on course.

It allows us to track our progress, identify areas where we can improve, and make necessary adjustments to our financial plan.

Regular reviews keep us accountable and ensure we remain aligned with our goals.

Suggestion: Schedule a monthly financial review where you assess your income, expenses, savings, and progress toward your financial goals.

If you notice any deviations from your plan, adjust your strategies accordingly.

The Value of Financial Education

Financial education is an investment in ourselves.

It equips us with the knowledge and skills to make informed financial decisions.

By continuously expanding our financial literacy, we empower ourselves to navigate the complexities of personal finance effectively.

Dedicate time to reading financial books, attending workshops, or taking online courses on investing, budgeting, and retirement planning.

Embracing Patience and Long-Term Thinking

Financial success is not a sprint; it’s a marathon.

Embrace patience and long-term thinking, understanding that success results from consistent effort and dedication.

It encourages us to stay focused on our goals, even when faced with challenges.

Suppose you’re investing for retirement. Understand that your investments may experience fluctuations in the short term.

Still, a long-term perspective acknowledges that these fluctuations are part of the journey toward your retirement nest egg.

Avoiding Emotional Spending

Emotional spending often leads to regret.

Recognizing and addressing the emotional triggers that drive impulsive purchases, we can develop healthier coping strategies for stress, anxiety, or other emotional challenges.

If you find yourself tempted to shop online when stressed, create a list of alternative stress-relief activities such as meditation, exercise, or spending quality time with loved ones.

Diversifying Your Income Streams

Exploring multiple income streams can provide financial stability and accelerate your journey toward money manifestation.

It reduces reliance on a single source of income, making us more resilient to economic fluctuations.

If you have a full-time job, consider starting a side business or freelancing in your spare time.

The additional income can significantly impact your financial stability and goals.

Staying Informed About Financial Markets

If you need to be an active investor, staying informed about financial markets can help you make better financial decisions.

Understanding how global events impact your finances allows you to adjust your strategies accordingly.

Follow financial news sources, read articles, and subscribe to newsletters that provide insights into economic trends and market developments.

Practicing Gratitude for Financial Abundance

Gratitude serves as a powerful mindset shift from scarcity to financial abundance.

By expressing gratitude for your current financial situation, you open yourself to the possibility of attracting more wealth into your life.

It’s a reminder that every step on your financial journey, no matter how modest, is a step toward success.

Each day, take a moment to reflect on something financially positive in your life.

It could be as simple as having a roof over your head, a warm meal, or the opportunity to pursue your passions.

Nurturing Success Through Positive Money Habits

When it comes to handling your cash, think of positive money habits as the threads that keep the whole financial picture intact.

They guide us toward wealth manifestation and success by transforming our beliefs, actions, and decisions.

Remember that financial abundance is not just about reaching a destination; it’s about the path you choose.

Take on these good money habits with patience and grit, and you’ll turn your money dreams into reality, cruising through the twists and turns on the road to success.

🍀 Recommended for you 🍀

In the AI era, setting clear goals is vital. As AI reshapes industries, adaptability and strategy become essential. This e-book delivers practical strategies for effective goal-setting, ensuring you thrive. Rather than just theory, this book has 21 chapters, and 73 pages that provide actionable steps for readers to apply in real life. It’s suitable for readers from various walks of life looking to set and accomplish personal or professional goals.